Taxes are amounts that citizens must pay to the government according to the law. Paying taxes is the duty of all citizens, while the right to collect taxes belongs to the government or state. The government uses the collected taxes for public welfare, such as building roads, schools, and bridges. It also uses taxes to pay government employees, teachers, police, and the military. Taxes are the main source of the government’s income or revenue. The government collects taxes based on citizens’ income, spending, and wealth. People with higher income and wealth, or higher expenses, pay more taxes.

Types of Taxes:

There are two main types of taxes:

1.Direct Taxes: These taxes are paid directly by the person on whom the tax is levied. The burden of these taxes cannot be transferred to someone else. For example, income tax is a direct tax. It is charged on a person’s income, and the person who earns the income must pay the tax. Other examples of direct taxes include property tax, vehicle tax, and land tax. This type of tax can be increased or decreased as needed and is progressive. People with lower income and wealth pay less, while those with higher income and wealth pay more.

Features of Direct Taxes:

1.The burden cannot be transferred to another person.

2.There is certainty about the amount to be paid.

3.These taxes are flexible.

4.They have an educational value.

5.They help control prices.

6.They are productive.

2.Indirect Taxes: These taxes are levied on a person, but the burden can be transferred to another person. For example, Value Added Tax (VAT) is an indirect tax. The government charges the seller a 13% VAT and the seller adds this amount to the price of goods, passing the tax burden to the consumer. Other examples include customs duties, sales tax, and entertainment tax. This type of tax is difficult to avoid, and everyone must pay it, making its base broader.

Features of Indirect Taxes:

1.The burden can be passed on to someone else.

2.The base is wide, meaning more people contribute.

3.It is difficult to avoid.

4.It is easy to pay.

5.It causes price increases.

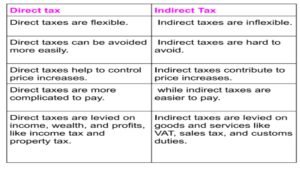

Differences between Direct and Indirect Taxes:

- Non-Tax Revenue:

Non-tax revenue is the income of the government earns from sources other than taxes. This includes donations or aid received from within or outside the country during natural disasters. It also includes fees collected by the government for services like issuing driving licenses, registering businesses, and charging fines. Additionally, the government earns revenue from renting out public properties like forests, land, rivers, and mines.

![setopati.com logo {"remix_data":[],"remix_entry_point":"challenges","source_tags":["local"],"origin":"unknown","total_draw_time":0,"total_draw_actions":0,"layers_used":0,"brushes_used":0,"photos_added":0,"total_editor_actions":{},"tools_used":{"transform":1},"is_sticker":false,"edited_since_last_sticker_save":true,"containsFTESticker":false}](https://setopatimedia.com/wp-content/uploads/2024/08/setopati.com-logo.jpg)